The Importance Of Teaching Financial Literacy

by Dawn Casey-Rowe

I grew up in banking family. There were times when we were doing well and times when we weren’t. I experienced both ends of the wealth spectrum as a child. I saw that sometimes even people who are doing all the right things get taken off guard by unexpected financial pressures like job changes and bad economies.

That’s what happened to my dad. He left banking and began starting soup kitchens. Soup kitchens and ministry don’t pay a lot, and the family suffered financially. Eventually, Dad went back into finance, but it was an uphill climb in the middle of a recession.

That’s where I learned the art of frugal and how to stretch a dollar.

Though I had a great foundation in financial literacy and knew better, I made nearly every mistake in the book in my 20’s. I took out a huge amount of student loans, overspent on credit cards, and switched careers, cutting my salary in half to teach, while never adjusting my spending. Then, I cashed out my 401K to pay down debt and remortgaged my house to infuse money into a struggling business.

Debt creeps up slowly, one mistake at a time. Teaching the discipline of financial literacy is the only cure.

I knew I was supposed to pay down that debt and save for retirement ASAP but there were other factors on the horizon and The Great Market Crash sucked me in. I had a new lower salary, a struggling business, credit cards, and tons of bills that were screaming for money.

I had to do something drastic. I had to take my financial well being into my own hands and dig myself out. That is what I did.

That is why I teach financial literacy to students.

More and more, Americans are skating at the edge of financial disaster. Adults feel baffled by financial literacy. People know they’re supposed to save, prepare for retirement, and have money sense, but they get overwhelmed, feeling powerless to change.

Many Americans are only one or two paychecks away from doom, the slightest breeze in the economy can push any one us over like the first domino in a chain reaction of disaster.

We don’t want to teach those habits to our kids.

Students are not educated properly in financial literacy.

It took me a long time to start to dig out of my debt and begin to think about retirement, but I’d taken the steps I needed to start unraveling the mess. That is the secret–to learn, then do.

As I made progress, I told the stories to students. I told them what not to do as well as how to start their careers out right–with solid fundamentals in financial wellness.

I want my students to be better off than I was. I want them to start the game ahead, so I started layering financial literacy into any class I was teaching, first as a side note then as a central theme.

It’s no accident that financial literacy instruction is the number one thing my students request when I ask what they want to learn. They want to learn how to buy houses, cars, get apartments, start businesses, and ask, “What’s the big deal about the college loan, anyway?”

Sadly, financial literacy, money management, and entrepreneurship or investing isn’t part of the cannon of things we teach, and in many schools it’s lucky to be an elective. By the time kids get to high school, it’s too late anyway. They need to have good solid habits in place the minute they learn how to recognize a dime.

Maybe you don’t feel as passionate about the subject of financial literacy as I do, but you still realize it’s something students need, Perhaps you haven’t formally studied it, but you want to dive in?

PricewaterhouseCoopers, one of the “Big Four” accounting firms in the US, has designed the Earn Your Future curriculum to help raise awareness for and teach the importance of financial literacy from a very young age.

With this curriculum–fully aligned to the Council for Economic Education’s National Standards for Financial Literacy–PwC asks, “What is missing in today’s education?” The answer, “the knowledge, skills, and understanding to manage money and make good decisions about…finances.”

Students who do not learn about financial wellness become adults who aren’t wise with their money. Over time, these bad purchases, excessive student loans, and predatory debt compound into a lifetime of disadvantages. It can take a minute to make a financial mistake, fail to read the fine print, skip the research, or give a “yes” that should be a “no.”

It takes years to dig out and get back into the black.

The PwC Earn Your Future K-12 curriculum is completely free, sponsored through the PwC Charitable Foundation, which commits over 31.4M to education, humanitarianism, and to the people of PwC in times of need. Currently, there are three modules–elementary, middle school, and high school. There is a core set of lessons, supplemented with well-produced and engaging videos and activities, however there are plans for more lessons and material. As a teacher, a financial literacy fan, a business owner, a mom, and a reformed mistake maker, I’m very much looking forward to these additional offerings “coming soon.”

The platform is currently sufficient to take a class through the basics of financial literacy, but with the additional offerings, I’m confident this will be a go-to in financial education. The units are self-paced, and there is a teacher dashboard which records progress. If you, like me, have a lot of students, you can easily sign up as a teacher and upload your information as a .csv file. Additionally, there’s a robust page of resources as well as well as an online financial calculator students can access to supplement the lessons.

If you’re a homeschooler or parent interested in giving your child a head start, this is a perfect place for you, too.

It’s important to teach financial literacy at every opportunity, starting from a very young age. It’s especially critical in this changing economy where students are expected to have several careers at a much lower starting salary than the prior generation. This means they’ll need to be clever and create their own opportunities, then be responsible with the money they earn. Financial education is more important than ever.

Whether I’m teaching good money habits at home with my son or urging students to “dare to compare,” financial literacy is a critical component of today’s education. I’m sad that it’s not part of the core curriculum for most, but with programs like PwC Charitable Foundation’s Earn Your Future every student has the chance to learn money management and financial well being like a pro.

Along with programs to teach our children financial literacy–there are apps and software to simplify the technical aspects and be overall more efficient. Apps like Excel and Word offer plenty of features for projections, calculating trends, and tracking data. An example of this is the Word Invoice Receipt Template from Microsoft Word. Microsoft Word offers various features like this to create a simpler experience for new learners or experienced experts.

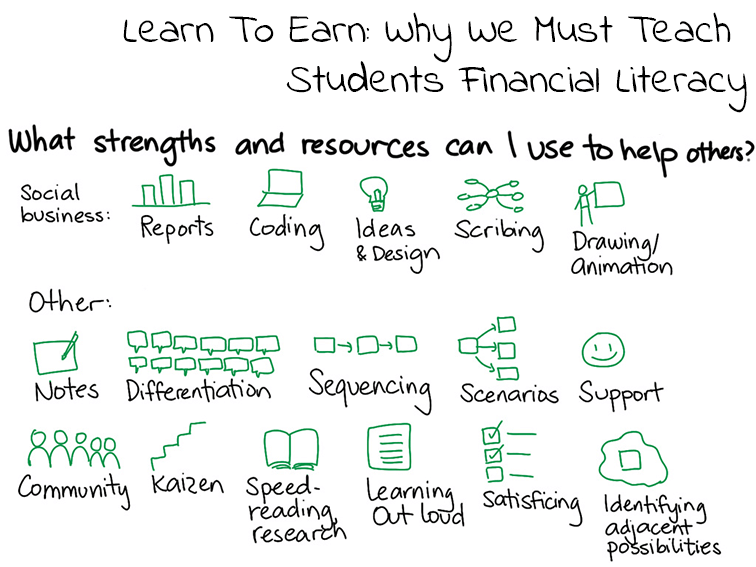

Learn To Earn: Why You Must Teach Students Financial Literacy; adapted image attribution flickr user sachachua